how much is the nys star exemption

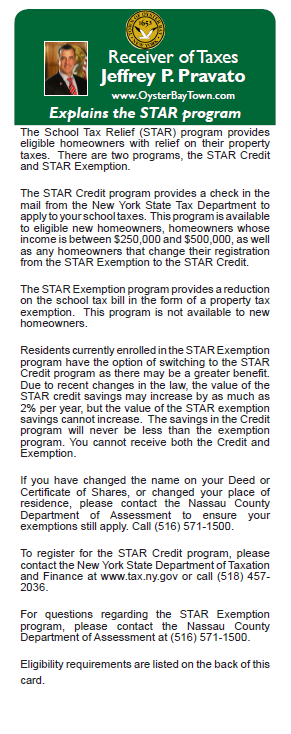

You can use the check to pay your school taxes. The formula below is used to calculate Basic STAR exemptions.

2018 Question And Answers About Enhanced Star Ny State Senate

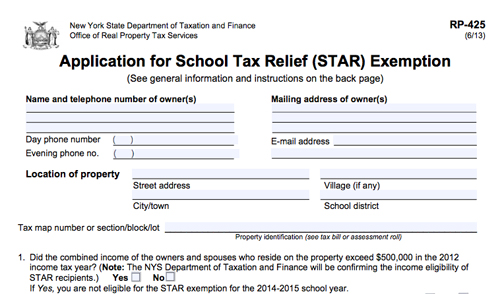

Exemption forms and applications.

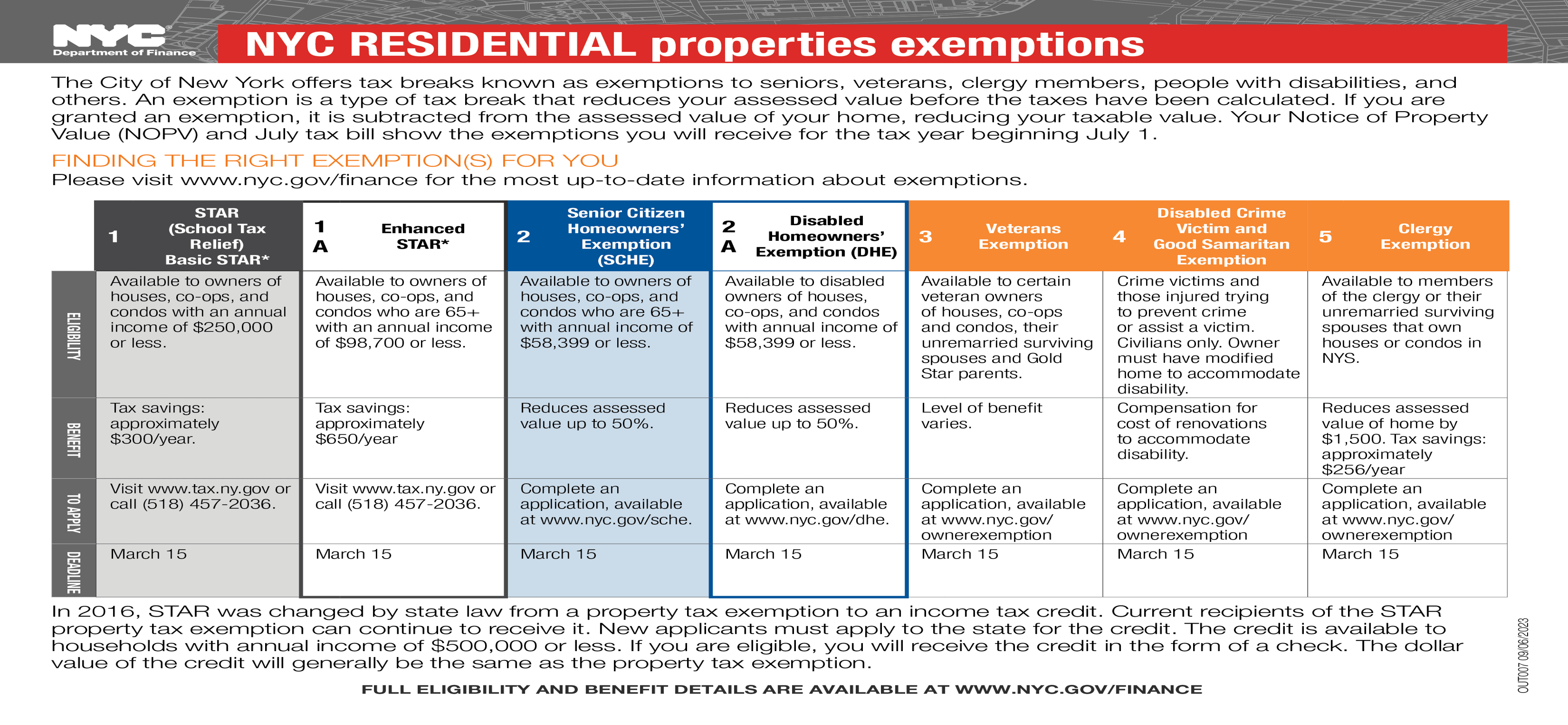

. Basic STAR Exemption and Star ENHANCED Exemption. If you owned the property on March 15 2015 it is your primary residence and you received the STAR exemption for the 2015-16 tax year you may qualify to keep the STAR exemption. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply.

The total amount of school taxes owed prior to the STAR exemption is 400. If you require a paper copy of the. How much are New York state property taxes.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or. Seniors must currently receive the Basic STAR property tax exemption the owner of the property will be at least 65 years old by December 31 2022 they have had 2020 income. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application.

The total income of all owners and resident spouses or registered domestic partners. Make under 500000 or under per household for the STAR credit and 250000 or under for the STAR exemption Seniors are eligible for Enhanced STAR if they are. The enhanced STAR exemption will provide an average school property tax reduction of at least.

As of 5119 the yearly STAR exemption savings has been capped and is no longer eligible for the yearly 2 increase that the Rebate Check Program will be receiving. The benefit is estimated to be a 293 tax reduction. The 2022 STAR exemption amounts are now available online except for school districts in Nassau County which we will certify in May.

Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions. For instance if you live in Albany County in the City of. The formula below is used to calculate Basic STAR exemptions.

Enhanced STAR exemption applicants must submit. STAR exemption amounts Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year. Seniors will receive at least a 50000 exemption from the full value of their property.

The income limit for the basic star credit is 500000 the income limit for the basic star exemption is 250000. In this example 90805 is the lowest of the three values from Steps 1 2 and 3. The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the value of the.

The Maximum Enhanced STAR exemption savings on our website is 1000. Enhanced STAR is for homeowners 65 and older whose. It is necessary that you own a home and have an income of 50000 or less owner and their spouse together STAR exemptionthis is a.

The income limit for the Basic STAR credit is 500000 the income limit for the Basic STAR exemption is 250000. Basic STAR is for homeowners whose total household income is 500000 or less. Based on the first 30000 of the full value of a home How.

Subtract the basic STAR exemption amount from your propertys value as determined by your assessor for local property tax purposes. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR.

Town Of Wheatland Assessor S Office

Basic Star Exemption Deadline Approaches

Don T Rush Out To Re Register For Star Just Yet The Suffolk Times

Deadline Coming Up For Seniors To Apply For Enhanced Star Exemption Wham

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Enhanced Star Program Information Town Of Coeymans

Star Program How To Maximize Your Ny Property Tax Rebate

New York S Star Rebate Program Undergoes Changes

Tax Exemptions Town Of Oyster Bay

Star Program In New York This Big Change Won T Happen This Year

The School Tax Relief Star Program Faq Ny State Senate

Nys Assembly Passes Bill To Revert Star Tax Rebates Wham

New York State Assembly How The Star Program Can Lower Your Property Taxes